2-Day Classroom Learning

Course ID: TGS-2025052407

Financial Management

Master the power of numbers and strategy with Financial Management for Accountancy — a high-impact course designed to sharpen your financial instincts and strategic thinking.

Gain essential tools for smarter planning, sharper analysis, and confident financial decisions. Whether aiming to boost performance or make bold moves, this course is your path to mastering the language of business and maximizing every dollar.

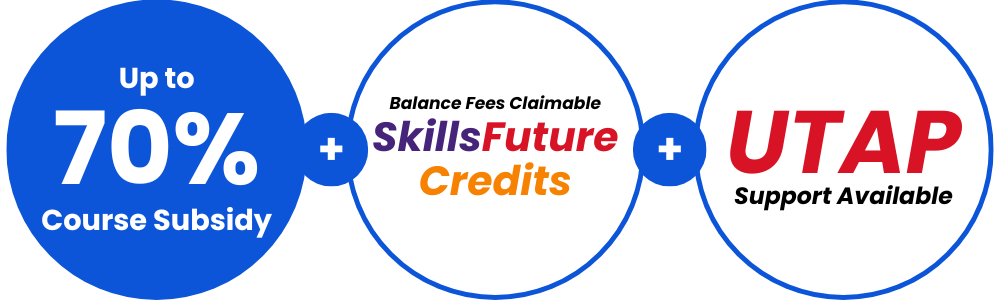

Spend little to nothing with funding & subsidies (based on eligibility)

Our Clients from Industry-Leading Organisations

why choose Financial Management?

This financial management course is a powerful step toward taking charge of your financial future. It builds essential skills in budgeting, analysis, and investing — key for growing personal wealth and advancing your career. With improved financial literacy, you'll make smarter decisions, avoid costly mistakes, and unlock opportunities for long-term success and financial confidence.

*Learners need to possess basic information and communication technology (ICT) skills. There are no *pre-requisites for professionals who would like to pursue the certification course.

Core Competencies You'll Gain:

Assess financial health

Analyze profitability

Track equity changes

Evaluate risks/opportunities

AI Agents

Financial Management Course Details

This course is designed for individuals seeking practical, in-demand financial skills to thrive in today’s dynamic economy. The course meets the growing need for financial literacy by equipping learners with hands-on training in budgeting, financial planning, and strategic analysis. Perfect for professionals considering a career transition, those looking to strengthen their current financial knowledge, or anyone eager to take control of their personal or business finances, this course empowers participants to make informed decisions and unlock exciting new career opportunities in finance and beyond.

Online via Zoom

2 Days,

9.00am to 5.30pm

Expert-Led Learning

Course Fee & Subsidies

Singaporeans aged

40 and above

Course Fee

$1,079.10

70% WSQ Subsidy

-$693.00

SFC Credits

-$386.10

Amount to Pay

$0

Singaporeans aged

below 40

Course Fee

$1,079.10

50% WSQ Subsidy

-$495.00

SFC Credits

-$584.10

Amount to Pay

$0

Permanent

Residents

Course Fee

$1,079.10

50% WSQ Subsidy

-$495.00

Amount to Pay

$584.10

*Please note that a $20 non-refundable registration fee applies for all course registrations

*Prices quoted are inclusive of GST at the prevailing rate

SFC

All Singaporeans aged 25 years old and above can use their SkillsFuture Credits to fully offset the remaining fees.

UTAP

In addition, NTUC members can utilize UTAP to offset 50% of remaining fees (capped up to $250 per year)

Have questions? Read FAQ or Contact Us

Upcoming Course Dates For Financial Management Course

No schedule dates available for this course.

Meet Your Trainers

Goh Cheng Hau, Gary

Expert Data Analyst and Educator

Gary is a seasoned data analyst with extensive experience working in leading software and biotechnology companies. As a CPE-Registered adjunct lecturer, he has taught and examined diploma to postgraduate courses across multiple private education institutions. Gary holds an MBA in Finance, a BSc in Finance, and a Specialist Diploma in Big Data Analytics. His professional certifications include the Microsoft Professional Program for Data Science and the Advanced Certificate in Training and Assessment (ACTA).

Dedicated to lifelong learning, Gary is currently pursuing a Master of Science in Analytics at Georgia Tech, one of the world’s top-ranking universities for computer science. His passion lies in uncovering business opportunities through data and communicating findings through effective data storytelling. Skilled in tools like SQL, Python, Tableau, Power BI, and Excel, Gary brings a wealth of practical expertise to his training sessions, ensuring participants gain actionable insights and hands-on skills.

Dwight Nuwan Fonseka

Generative AI Specialist and Educator

With over 20 years of expertise at the intersection of technology, data science, and education, Dwight Nuwan Fonseka is a leading expert in Business Intelligence, AI, and Data Analytics. His unique multidisciplinary background—holding a degree in Biotechnology from NUS and a Master’s in Education from NTU—enables him to bridge the gap between cutting-edge technology and practical business applications.

As a Senior Data Analyst, Dwight has applied predictive modeling, deep learning, and machine learning to tackle real-world challenges, particularly in healthcare. He has mastered Power BI, SQL, Python, R, and AI frameworks like Keras and h2oAI, allowing him to transform raw data into compelling insights. His expertise spans data storytelling, Generative AI, and GANs, ensuring that learners stay ahead in the evolving landscape of analytics and automation.

Financial Management Course Outline

Kick off with a strong foundation with our detailed and practical curriculum in Financial Management – guiding you step-by-step towards mastery.

Learning Outcome: Analyze the strategic importance of the statement of financial position in evaluating an organization’s financial health and stability.

Topics:

- Statement of Financial Position vs Balance Sheet

- Strategic Role of the Statement of Financial Position: Understanding its purpose and relevance in financial decision-making.

- Key Components of the Statement: Assets, Liabilities, and Equity, and their impact on financial health.

Learning Outcome: Compare income statements to identify profitability patterns.

Topics:

- Components of the income statement: Revenue, expenses, and net income

- Analyzing profitability: Gross profit margin, operating margin, net profit margin

- Key components of cash flow statements: Operating, investing, and financing activities

- Importance of cash flow for organizational sustainability

Learning Outcome: Assess the statement of changes in equity to evaluate shareholder value.

Topics:

- Retained earnings, dividends, change of share capital

- Purpose and significance of changes in equity

- Role of equity in assessing organizational performance

- Understanding the drivers of changes in equity

- Importance of equity movements in reflecting organizational performance

Learning Outcome: Evaluate strategic financial analysis techniques to uncover risks, identify opportunities, and evaluate long-term financial stability.

Topics:

- Recognize and interpret financial shifts over time across various statement types.

- Analyze liquidity, solvency, and efficiency using current ratio, quick ratio, and debt-to-equity ratio.

- Assess profitability, liquidity, solvency, and efficiency relative to industry benchmarks.

- Combine data from income statements, balance sheets, and cash flow statements to uncover risks and opportunities.

- Evaluate trends in cash flow ratios (e.g., cash flow to debt, cash conversion cycle) and revenue patterns for sustainability.

- Identify and compare retained earnings, dividends, and share issuances to assess financial stability.

Learning Outcome: Propose actionable recommendations to stakeholders based on the financial statement analysis.

Topics:

- Analyze and interpret financial data to develop actionable strategies for organizational improvement.

- Prepare and interpret equity and cash flow statements to assess organizational liquidity and strategic alignment.

- Present findings and recommendations to stakeholders, aligning with organizational objectives.

- Synthesize data from financial statements to provide comprehensive insights for stability and growth.

Course materials will be provided in soft copy (digital format) as part of our eco-friendly and sustainability effort. Printed hard copies are available upon request. For any special requests (e.g., printed materials or accessibility needs), please inform us in advance.

3 Easy Steps to Enroll

1

choose desired course schedule

Choose convenient classes on evenings or weekends.

2

subsidy calculation

Fill out the form to calculate your government subsidies.

3

register online

Secure your place with a deposit and start your journey today.

10 reasons to choose aventis for your Financial Management training

Learn from experienced financial educators and industry practitioners.

Practical, case-based training focused on budgeting, analysis, and strategic planning.

Designed in consultation with finance professionals to meet real-world needs.

Nationally recognized qualifications supported by SkillsFuture Singapore.

Equip yourself with skills that boost employability and career advancement.

Access ongoing resources, career coaching, and networking opportunities,

Affordable education made accessible through subsidies.

Lessons are conducted via Zoom.

Enjoy close mentorship and dedicated instructor support.

Equip yourself to succeed in the blockchain-driven economy.

achieve mastery in Financial Management today

Upon successfully completing the WSQ - Financial Management course at Aventis Graduate School, you will receive a WSQ Statement of Attainment recognized by employers in Singapore. This certification serves as a testament to your expertise in digital assets, helping you showcase your skills to potential employers and professional networks.

Bonus Tip: Display your certification on LinkedIn to strengthen your professional profile and capture the attention of potential employers.

What our students say about Aventis

FAQ

Financial Management is the strategic handling of finances to achieve stability and long-term success. It covers budgeting, planning, investing, risk management, and cost control to ensure effective resource use and cash flow. Strong financial management helps individuals and organizations reduce debt, grow wealth, and make informed financial decisions.

Learning financial management is important because it empowers individuals and organizations to make informed, strategic decisions about money. It equips you with the skills to budget effectively, manage debt, invest wisely, and plan for future goals. With strong financial knowledge, you can avoid common pitfalls, improve financial stability, and build long-term wealth. For professionals, it enhances career opportunities and decision-making confidence, while for individuals, it promotes financial independence and peace of mind. In a world where financial literacy is crucial, mastering financial management is a key step toward lasting success.

Yes, up to 70% funding support is available from The Institute of Banking & Finance (IBF) for our IBF-accredited programmes:

The IBF Standards Training Scheme ("IBF-STS") offers funding for training and assessment programmes accredited under the Skills Framework for Financial Services.

Eligible Singaporeans and PRs enrolled in our IBF-accredited courses can receive funding support through IBF-STS, subject to fulfilling all eligibility requirements.Yes. For self-sponsored Singaporeans aged 25 years old and above, you can use your SkillsFuture Credit to offset the remaining course fees after WSQ funding.

To check your SkillsFuture credit balance, please follow these steps:

- Go to https://myskillsfuture.gov.sg

- Click on ‘Submit SkillsFuture Credit Claims’

- Login with your SingPass

- Click on the arrow (>) at the top right hand corner. You will be able to see a drop-down list of your Available SkillsFuture Credits.

After you have registered for a course, an Aventisrepresentative will reach out to guide you with the SkillsFuture Credits

*Please note that our courses are not eligible for “Additional SkillsFuture Credit (Mid-Career Support)’. You will only be able to use available credits from ‘SkillsFuture Credit’ and ‘One-off SkillsFuture Credit Top-Up’.Yes, all our courses are eligible for Union Training Assistance Programme (UTAP) Funding. NTUC Union members can use UTAP to offset 50% of unfunded course fees (capped at $250 per year).

This claim must be done after completion of the course. Please refer to the UTAP FAQ for more information.

Yes, both can be utilized concurrently. UTAP claims are processed after SkillsFuture Credits have been applied.

Illustrative Example:

- Total Course Fee: $1,000

- IBF Subsidy (70%): $700

- Remaining Fee: $300

- SkillsFuture Credit Applied: $200

- Out-of-Pocket Expense: $100

- UTAP Reimbursement (50% of $100): $50

- Final Cost After Reimbursements: $50

A laptop is required for this course. No special software or other hardware is required for this course participation.

Upon successful completion of this IBF-accredited course, you'll receive a Financial Management certification to showcase your knowledge and expertise in this field.

Our programmes are highly respected by leading companies, who actively shape our curriculum and utilize our courses for employee training.

See what other courses our Financial Management enthusiasts are interested in…

Seize the opportunity! Enrol in Aventis' Financial Management course in Singapore now.

Supercharge Your Career with Generative AI & ChatGPT!

Supercharge Your Career with Generative AI & ChatGPT!

Industry Experts

Industry Experts Hands-On Learning

Hands-On Learning Up-to-Date Curriculum

Up-to-Date Curriculum Trusted Credentials

Trusted Credentials Career Advancement

Career Advancement Lifelong Learning Support

Lifelong Learning Support Subsidies Available

Subsidies Available 100% Online

100% Online Personalized Guidance

Personalized Guidance Convenient City Campus

Convenient City Campus